main street small business tax credit sole proprietor

CLICK HERE FOR INFORMATION ABOUT THE 2022 ELECTION CYCLE INCLUDING POLLING LOCATIONS AND TIMELINES CLICK HERE FOR ELECTION NIGHT RESULTS FROM THE 2022 PRIMARY ELECTION Information on how to best obtain services from the Secretary of States office during the COVID-19 situation can be found. What income should an Unincorporated sole proprietor business.

Sole Proprietorship And Your Import Export Business Dummies

NAICS North American Industry Classification Code.

. CLICK HERE FOR THE 2022 PRIMARY ELECTION VERSION OF FACTS VS. The loan guarantees provided by the Disaster Relief Loan Guarantee Program help mitigate barriers to capital for small businesses that have suffered a loss either physical or economic due to a disaster. 2 Must be a sole proprietor a business owner in a partnership or earn self-employment income by providing a service.

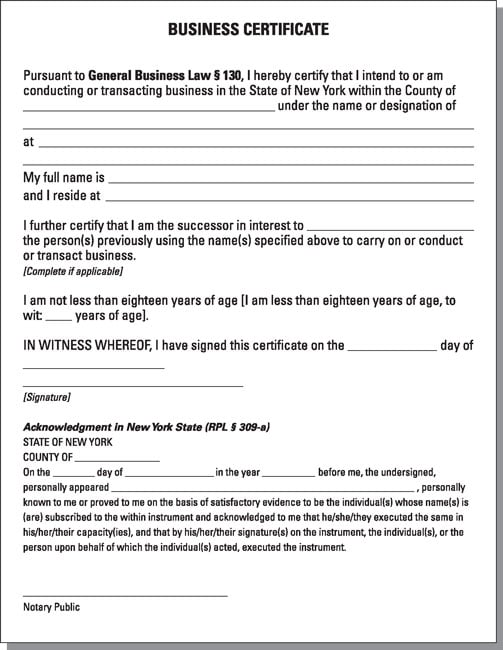

A Business Line of Credit. The names titles home address and Social Security number of the proprietor partners or. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone.

Funded by employer contributions. The Small Business Relief Grant is targeted at small businesses that have been most severely impacted by the COVID-19 pandemic. Using the fictitious name filing the employer can name the business and operate it under a name that is different than the owners full legal name the names of business partners or the name under which the.

Use the EIN previously provided. If you cannot locate your EIN for any reason follow the instructions on the Lost or Misplaced Your EIN. The Small Business Finance Centers Disaster Relief Loan Guarantee Program was created to help businesses recover from a declared disaster.

A business line of credit is a revolving loan that comes in two forms. The legal name or sole proprietor name and business address. Earnings are tax-deferred and contributions are tax-deductible.

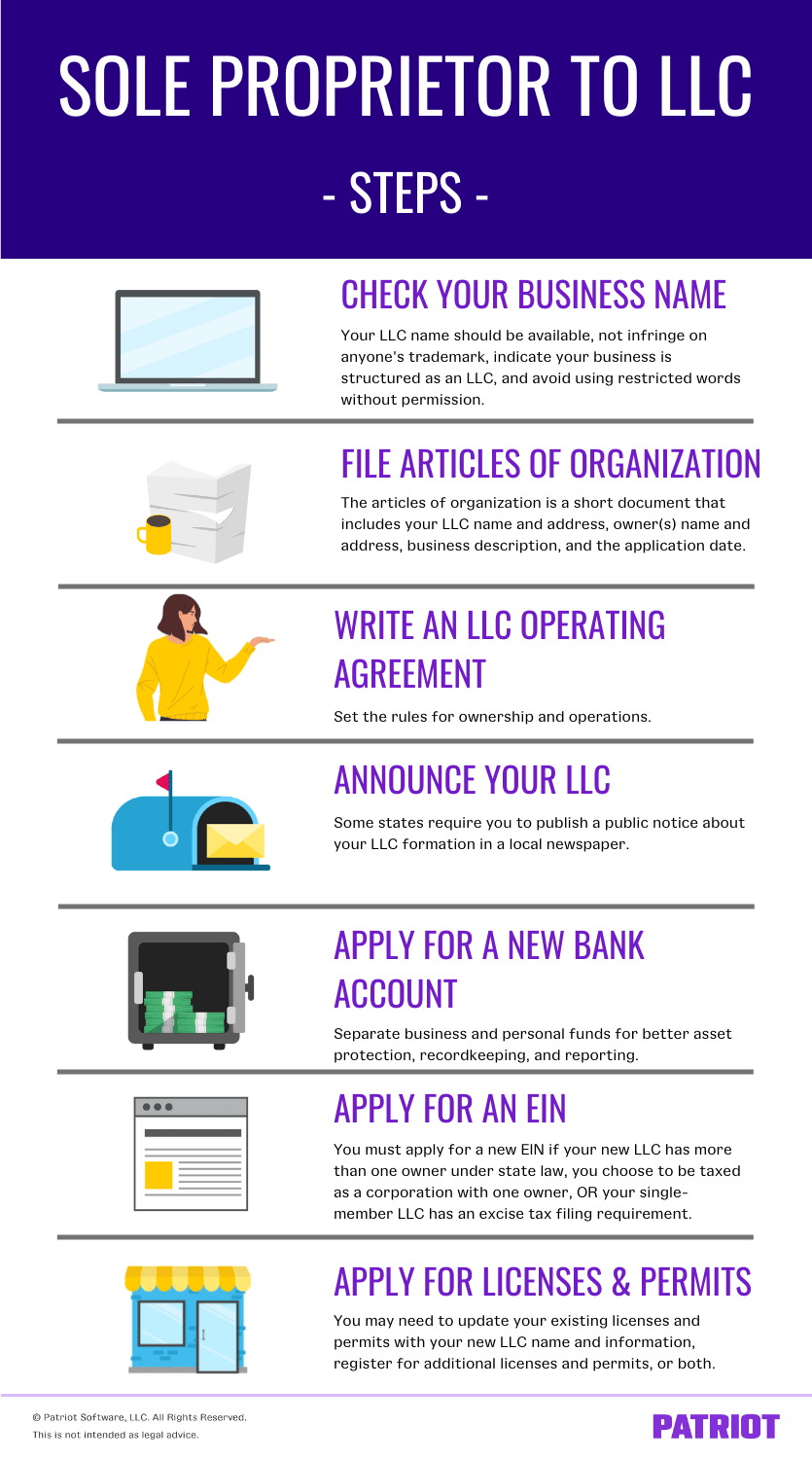

Small Retailer Property Tax Relief Credit Frequently Asked Questions FAQs Special Events. Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Partnership corporation sole proprietor Your business address.

How does it. An Incorporated business should report all income earned for work performed in the City. The program will provide eligible businesses with grants of up to 5000.

For example if you are a sole proprietor this is your first and last. The business name Certificate of Assumed Name if applicable. If you are a home-care service recipient who has a previously assigned EIN either as a sole proprietor or as a household employer do not apply for a new EIN.

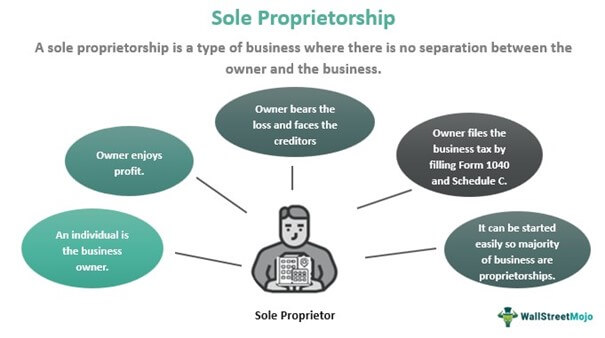

Need quotation to verify It is also any activity or enterprise entered into for profitHaving a business name does not separate the business entity from the owner which means that the owner of the business is responsible and liable for debts incurred by. Moreover a business line of credit can be used for cash advances. You will need your federal employer ID number FEIN if applicable.

Self-employed individuals or small-business owners primarily those with only a few employees. Business is the activity of making ones living or making money by producing or buying and selling products such as goods and services. If on the credit card application you come across a section asking for your business tax identification number you can list yourself as the sole proprietor.

Main Street RI Streetscape Improvement Fund. Business lines of credit typically have lower interest rates and higher credit limits. In Louisiana business owners and business partners can operate under a fictitious name filing also known as Doing Business As or DBA.

If you performed work both inside and outside the City limits an allocation may need to be made on page 2 Schedule Y of Form BR to determine the taxable portion to the City of Wilmington. Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations. Names and social security numbers of the sole proprietor officers partners or representatives.

It works a lot like a credit card but with better features.

Sole Proprietorship Definition Examples Advantages What Is It

Fillable Form 1040 2017 Income Tax Return Income Tax Tax Return

Amazon Com Schedule C Tax Deductions Revealed The Plain English Guide To 101 Self Employed Tax Breaks For Sole Proprietors Only Small Business Tax Tips Book 2 Ebook Davies Wayne Kindle Store

Sole Proprietorship Vs Llc Which Is Right For You Truic

Sole Proprietorship Partnership Corp Or Llc Landscape Business

4 Most Common Business Legal Structures Pathway Lending

Proprietorship Stock Illustrations 117 Proprietorship Stock Illustrations Vectors Clipart Dreamstime

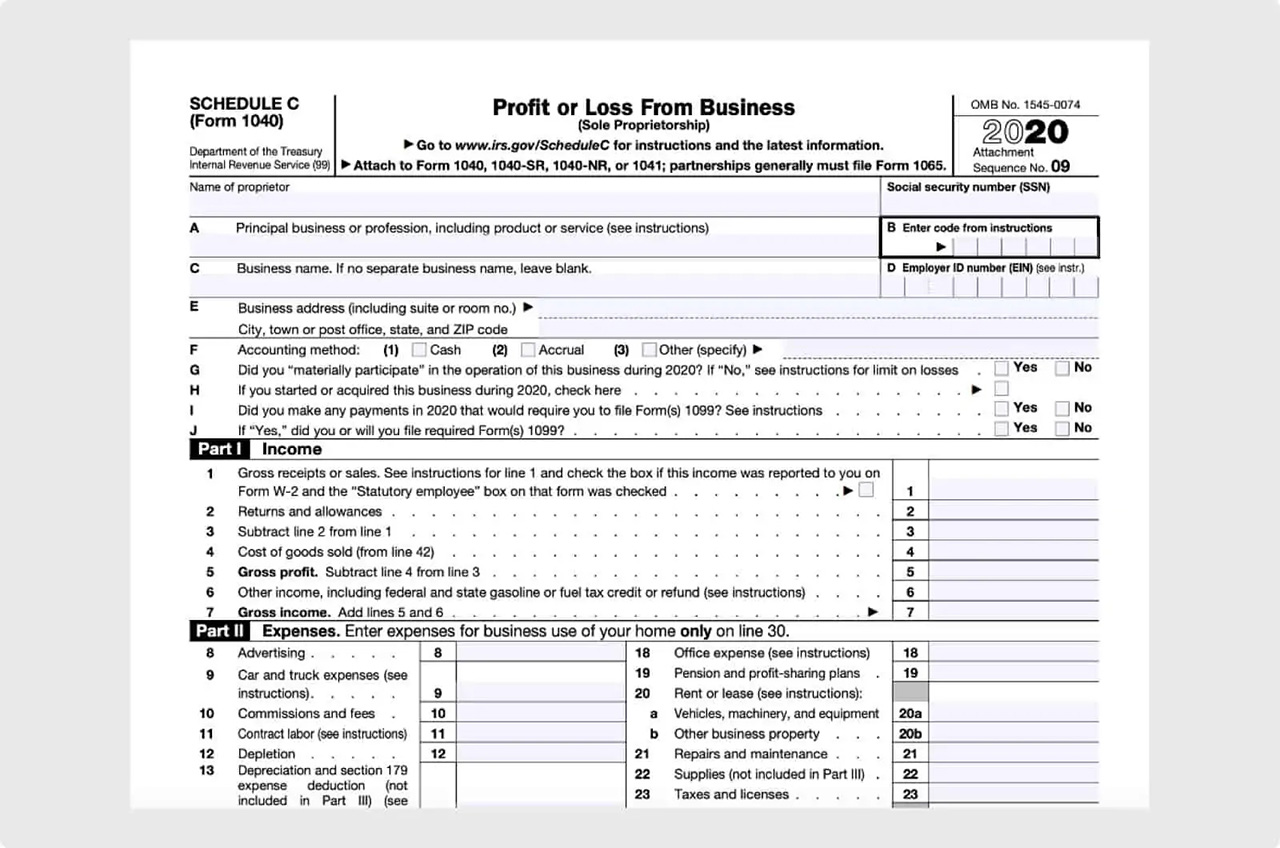

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

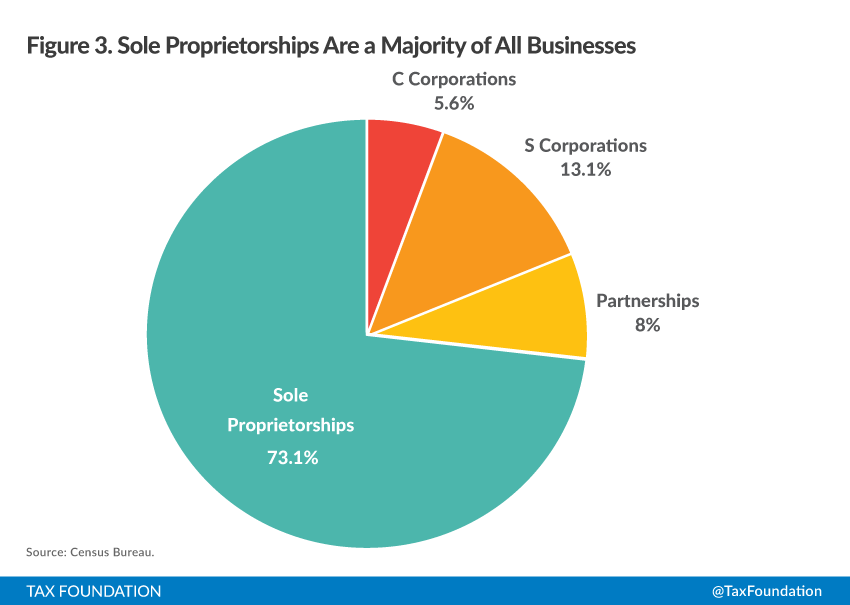

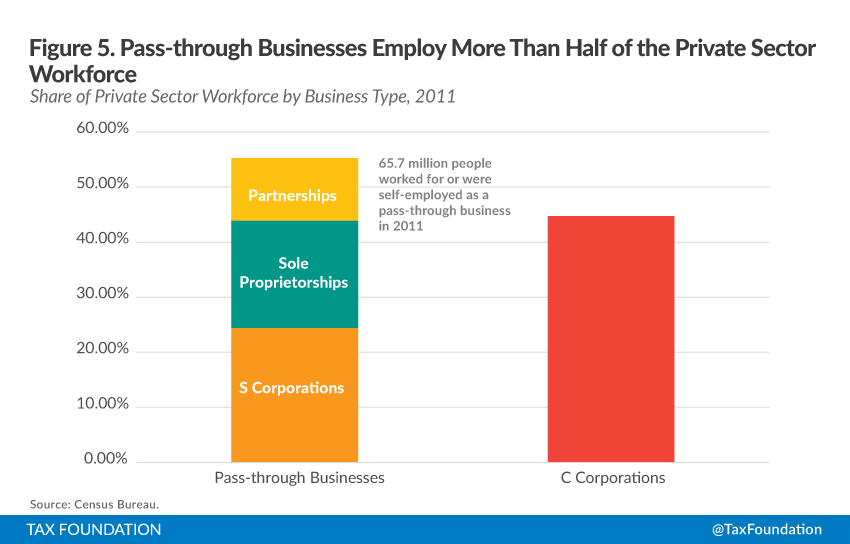

An Overview Of Pass Through Businesses In The United States Tax Foundation

Sole Proprietorship Definition Advantages And Disadvantages

Pin By Am On Commerce Stuff Business Ownership Legal Business Profit And Loss Statement

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Sole Proprietorship Self Employed With Employees Ppp Documents

Llc Vs Sole Proprietorship Business Type Comparison Simplifyllc

An Overview Of Pass Through Businesses In The United States Tax Foundation

Sole Proprietorship Vs Partnership Differences Between These Type Of Businesses

%20Tax%20Credit%20for%20Small%20Business%20Explained.jpg?width=801&name=Research%20%26%20Development%20(R%26D)%20Tax%20Credit%20for%20Small%20Business%20Explained.jpg)

Research Development R D Tax Credit For Small Business Explained